Plus what they are and how they work

You’re a savvy shopper who’s well aware of the dangers lurking on the web, right? This is why you shop on secure sites (if it’s not https, it won’t earn your dollar!). You may even use payment platforms like PayPal and Google Pay to safeguard your bank account details.

So why not take it a step further by using disposable one-time credit card numbers? Not familiar? Then let’s take a look at what these are and which ones you can trust.

How Do Disposable One-Time Credit Cards Work?

It sounds like something you’d find in a spy movie, alongside burner phones and code names. We assure you, one-time use credit cards are legit, just as long as you get them from a reputable source.

Disposable credit cards, aka virtual payment cards, use temporary numbers that you use once and throw away. You can obtain these through certain financial institutions and apps.

The purpose is to mask your credit card details in the event there’s a data breach. Your real credit card details aren’t revealed during these transactions, which provides an extra barrier of protection. This is similar to the virtual debit card services we talked about previously.

The temporary number is linked to your credit card and pulls money from your account when you use it.

Then the next time you need to make a purchase, you get another one-time use credit card number. Rinse and repeat. So where can you get your credit card disguise?

Revolut

If your current bank doesn’t offer disposable credit cards, then you can use an app like Revolut. All you have to do is:

- Open an account with Revolut

- Download the app

- Select the “cards” section

- Click “Add New Card” and then “Virtual” card

- Swipe right to the “Disposable virtual card”

- Click the pink button

Now, you’re good to go and can make purchases at any business that accepts MasterCard. You can do this each time you want to get a new virtual number.

Now, it’s also worth mentioning that there are different levels of users. You’ll have to be a premium member to access disposable virtual cards, which costs $10 per month. Also, you can use your disposable card number up to five times per day.

ecoPayz (Eco Virtual Card)

Now, if you’re on the prowl for a virtual card that allows you to pay in other currencies, then you should check out ecoPayz. With this virtual card, you can pay for products and services in Euro, GBP, and USD.

Like with Revolut, you can get your virtual card by logging into your account and selecting “ecoVirtualcard.”

Then you’re ready to start shopping online at stores that accept Visa. Once you use the card, the number is canceled so there’s no chance of it being stolen or misused.

To qualify for the virtual card, you first have to sign up for the Silver ecoAccount. This is €1.80 and isn’t currently available in the US. However, it works in 173 other countries, including many throughout Europe.

NetSpend

NetSpend does things a little differently — they allow you to generate up to six temporary virtual credit card numbers for online and mobile transactions.

Of course, you can cancel the number anytime you want so if you intend to use it once, then you can do so.

Some account holders use this to pay for trial subscriptions. This way, they can cancel the number before being charged (if they don’t want to continue). Otherwise, account holders can add their permanent NetSpend prepaid card number.

You can choose between their monthly or pay-as-you-go plans. If you upgrade to their Premier account, then you can reduce monthly costs by nearly 50%. Free plans are also available. You can use your virtual card anywhere that accepts Visa.

Citi Cards

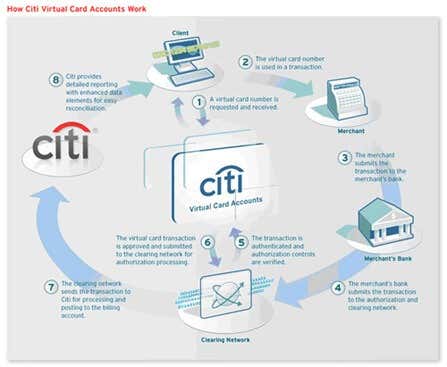

If you have a Citi card, then you may be eligible to generate virtual credit card numbers. These aren’t available with all Citi cards, so you have to check.

You can do this by logging in and checking your Card Benefits. Any transactions you make with your virtual card will appear on your account like any other purchase.

Plus, you can set dollar limits and expiration dates for your virtual numbers. Whenever you’re ready to close the virtual account, you can do so using Citi’s tool (which you can download to your PC).

Capital One Eno

Already have a Capital one card? Then you can use Capital One’s assistant (Eno) to generate virtual card numbers. You can access this by downloading the browser extension, which is available on Mozilla Firefox, Google Chrome, and Microsoft Edge.

Just click the extension button on your browser and you’ll be able to generate the virtual card. The browser extension also allows you to access Capital One’s site. From here, you can view, delete, and lock your virtual account numbers.

What’s great about Eno is you can generate your virtual number on the fly. While you’re at checkout, Eno appears and allows you to create a one-time-use number. It’s quick and seamless — exactly how consumers prefer their online shopping experience.

Now, if you don’t have a Capital One card, you’ll be happy to learn that Eno is available for other Capital cards, such as Venture Rewards card and QuicksilverOne Rewards card.

Shop Safer with Disposable Virtual Credit Cards

This is just a short list of the disposable virtual card providers out there today. As this grows in popularity, we can only expect the market to grow larger.

This is great news for savvy consumers who want more control over the security of their financial accounts.

So if you’re ready to start protecting your financial details, then give these reputable companies a try. Be sure to come back and let us know which you like the best!